huntsville al sales tax department

Please remit the City of Hartselles local tax to. A discount is allowed if the tax is.

/cloudfront-us-east-1.images.arcpublishing.com/gray/SBNCWTTUDZBSRB4QYQU7DCN7OQ.jpg)

Incentives How Much Did Luring Remington Plant Cost Al

4 beds 3 baths 1700 sq.

/cloudfront-us-east-1.images.arcpublishing.com/gray/SBNCWTTUDZBSRB4QYQU7DCN7OQ.jpg)

. This is the total of state county and city sales tax rates. May 6 2022 Friday NEW Tax Lien Sale Auction-. The current total local sales tax rate in Huntsville AL is 9000.

Monday - Friday 800 AM - 430 PM. For questions about Sales Tax you should contact the City Finance Department at 256 427-5080 or FinanceTaxhuntsvillealgov. 1-866-576-6531 Fax 334-242-8916.

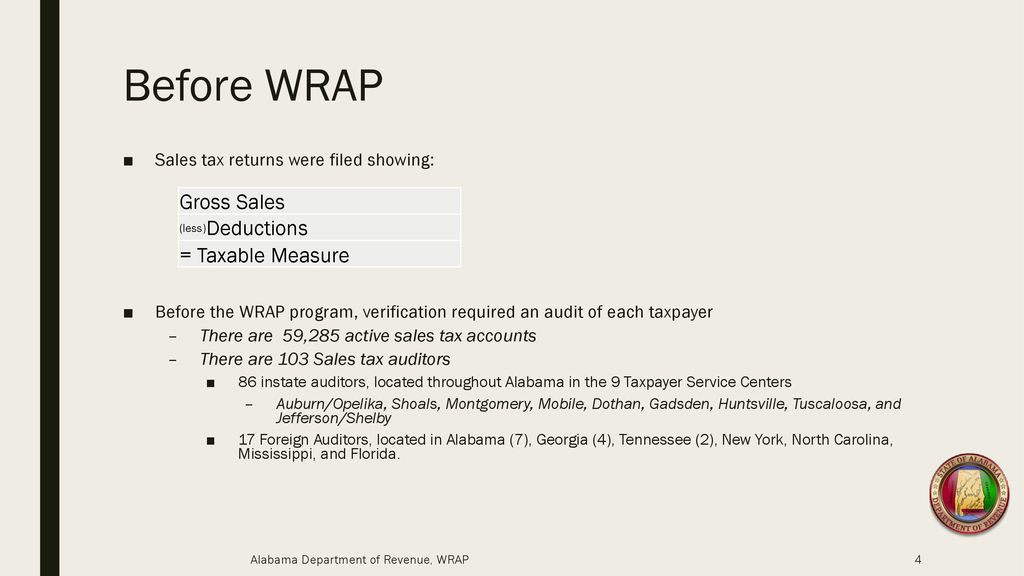

Huntsville collects a 5 local sales tax the maximum local sales tax. The Huntsville Alabama sales tax is 400 the same as the Alabama state sales tax. Sales and Use Tax Division.

1918 North Memorial Parkway Huntsville AL 35801 256 532-3498 256 532-3760. This page will be. Act 98-192 known as the Local Tax Simplification Act of 1998 required each county and municipality to submit to the Department a list of any sales use rental lodgings tobacco or gasoline taxes it levied or administered and the current rates thereof.

Box 308 Huntsville Alabama 35804-0308. See reviews photos directions phone numbers and more for Huntsville Tax Department locations in Decatur AL. If you need more.

Tax rate by-laws for Town and BIA. If you have questions give us a call at 256-532-3370 or email mctaxcollmadisoncountyalgov. The minimum combined 2022 sales tax rate for Huntsville Alabama is.

256 427-5000 Huntsville City Hall 308 Fountain Circle Huntsville Alabama 35801. The Huntsville sales tax rate is. Get Madison County Sales Tax rKaufman Lynd reviews rating hours phone number directions and more.

Are a lot to be responsible for. We call these tax rates today but in the past they were once referred to as mill rates. In order to assist Huntsville businesses in determining.

To report a criminal tax violation please call 251 344-4737. Box 11487 Huntsville AL 35814-1487. When is the sales tax due.

Ad Get In-Depth Property Reports Info You May Not Find On Other Sites. While Alabama law allows municipalities to collect a local option sales tax of up to 3 Huntsville does not currently collect a local sales tax. Tax Department 37 Main Street East Huntsville ON P1H 1A1.

The Alabama sales tax rate is currently. The Law requires that Hartselle local taxes be collected reported and remitted in the same manner as the State sales use rental and lodgings taxes. Alabama Tax Sales information registration support.

Get Madison County Sales Tax can be contacted at 256 532-3498. Post Office Box 327710. This page will be.

The completed form can be faxed to 256427-5064 or emailed to FinanceTaxHuntsvilleALgovWhen your new tax account has been established you will receive a letter andor email confirming your account number and filing requirement. However pursuant to Section 40-23-7 Code of Alabama 1975 th in order to file quarterly bi-annually or annually for that calendar year. Act 2018-150 requires all counties and municipalities to notify the.

The Alabama sales tax rate is currently. If you have any questions please call the department at 256 532-3498 and leave a message in our general mailbox or email us at salestaxinfomadisoncountyalgov. Access to Market Value Tax Info Owners Mortgage Liens Even More Property Records.

Madison county sales tax department madison county courthouse. It is the TAXPAYERS RESPONSIBILITY in the case of retail sales it is the SELLERS RESPONSIBILITY to determine whether a transaction occurs in Huntsville. E huntsville al 35801.

Did South Dakota v. City of Huntsville Clerk-Treasurer Department License Division 308 Fountain Circle 3rd floor Huntsville Alabama 35801. Complete a Tax Registration Form and return it to the Finance Department for processing.

Alabama Department of Revenue Toggle navigation. To help Alabama business owners better understand and master these requirements the Alabama Department of Revenue ADOR invites business owners to ADORs free Business. The minimum combined 2022 sales tax rate for Huntsville Alabama is.

The County sales tax rate is. What is the sales tax rate in Huntsville Alabama. Huntsville collects and administers the following taxes.

City of Huntsville Finance Department Dept. The City follows the same rules regulations definitions and procedures as are adopted by the Alabama Department of Revenue for the purposes of collection and administration of sales use rentalleasing. Mail completed application to.

See reviews photos directions phone numbers and more for Huntsville Tax Department locations in Downtown Huntsville Huntsville AL. The sales tax is due monthly with returns and remittances to be filed on or before the 20th day of the month for the previous months sales. 1-800-556-7274 PO Box 830725 Birmingham AL 35283-0725.

See reviews photos directions phone numbers and more for Huntsville Tax. The Tax Lien Auction and Sale process is New for Madison County. Madison County Sales Tax at 115 Washington St SE Huntsville AL 35801.

Search This Site MVD. Ad New State Sales Tax Registration. The City of Huntsville requires electronic filing for all Sales Use RentalLease and Lodging tax returns.

100 northside squar. Object Moved This document may be found here. The December 2020 total local sales tax rate was also 9000.

Sales reps or employees soliciting business in Huntsville. Alabama Department of Revenue. 6517 Marsh Ave Huntsville AL 35806 212500 MLS 1810705 This property is located within five minutes of Research Park Redstone Arsenal The Brid.

11407 Birmingham AL 35246-2108. Beer. City of Huntsville Clerk-Treasurer Department License Division P.

Consumer Use Gasoline Liquor Lodging RentalLeasing Sales Tobacco and Wine. 28 2020 State tax obligations for business owners licenses sales tax property tax withholding etc. Miles Madison County Tax Collector.

1918 North Memorial Parkway Huntsville AL 35801 256 532-3498 256 532-3760. THE SALES TAX DEPARTMENT OVERSEES THE FOLLOWING MADISON COUNTY TAXES ON BEHALF OF THE MADISON COUNTY COMMISSION. If you are not required to file returns electronically with the State of Alabama your completed tax form and check payable to City of Huntsville should be mailed to.

The Huntsville Sales Tax is collected by the merchant on all qualifying sales made within Huntsville. ADOR Sales Use Tax Division PO Box 327710 Montgomery AL 36132-7710. Motor Fuels Gas Excise Tax.

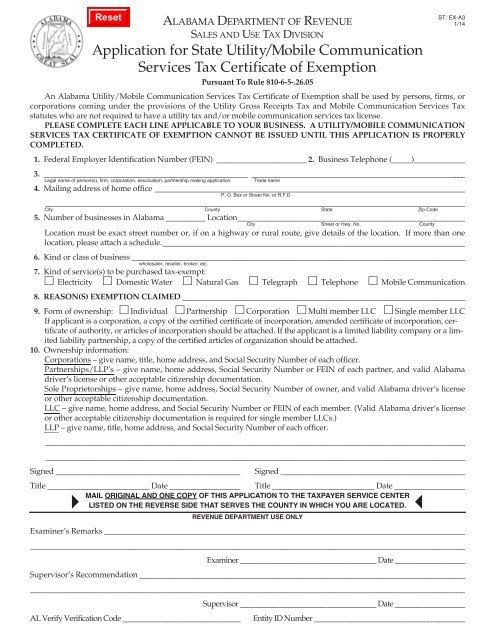

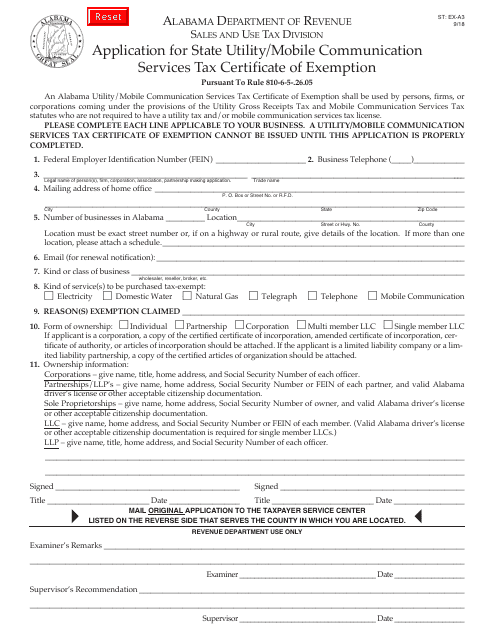

St Ex A3 Alabama Department Of Revenue

Huntsville S Sales Tax Will Jump To 9 Percent On March 1 City Council Rejects Sunset Clause Al Com

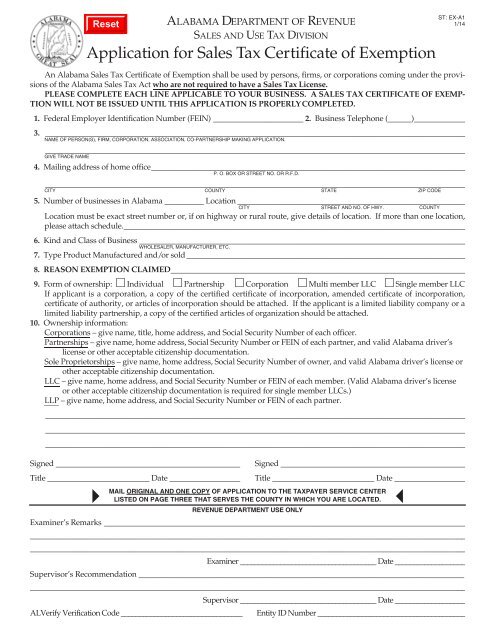

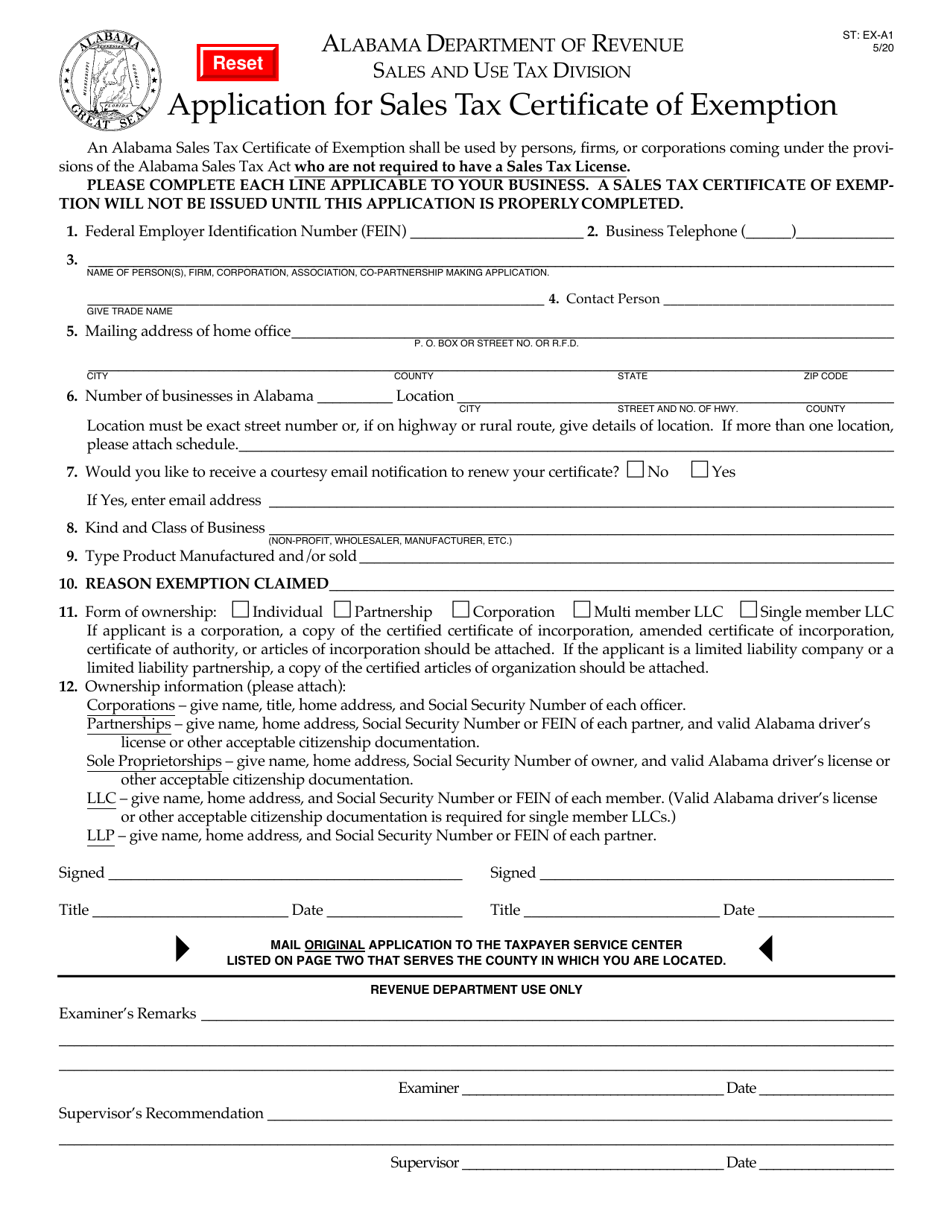

Application For Sales Tax Certificate Of Exemption Alabama

Form St Ex A3 Download Fillable Pdf Or Fill Online Application For State Utility Mobile Communication Services Tax Certificate Of Exemption Alabama Templateroller

Filing State Taxes Alabama Begins Processing Returns Today What To Know Al Com

Filing An Alabama State Tax Return Things To Know Credit Karma Tax

Madison County Sales Tax Department Madison County Al

/cloudfront-us-east-1.images.arcpublishing.com/gray/NQRE46PFVFFSBM4744XTKYQN3E.jpg)

Huntsville Convenience Store Operator Convicted For Failing To Pay Sales Taxes

Application For Sales Tax Certificate Of Exemption Alabama

Form St Ex A1 Download Fillable Pdf Or Fill Online Application For Sales Tax Certificate Of Exemption Alabama Templateroller

Alabama Sales Tax Guide For Businesses

Alabama 9501 Fill Online Printable Fillable Blank Pdffiller

Alabama Severe Weather Sales Tax Holiday 2022 Starts Today What S On The List Al Com

Madison County Sales Tax Department Madison County Al

Huntsville Store Owner Convicted Of Failure To Pay Sales Tax Huntsville Waaytv Com